Online Banking

Pacific Crest’s Online and Mobile App platforms offer a unified experience: Whether logging in from a smartphone, tablet or PC, your digital banking experience has a similar look and feel, making it easier to navigate and get things done.

Show Details

Online Banking Basics

Our online banking system integrates the latest industry features and offers clients enhanced ease of use.

Select Features:

- Review account balances and activity conveniently in one place from any device

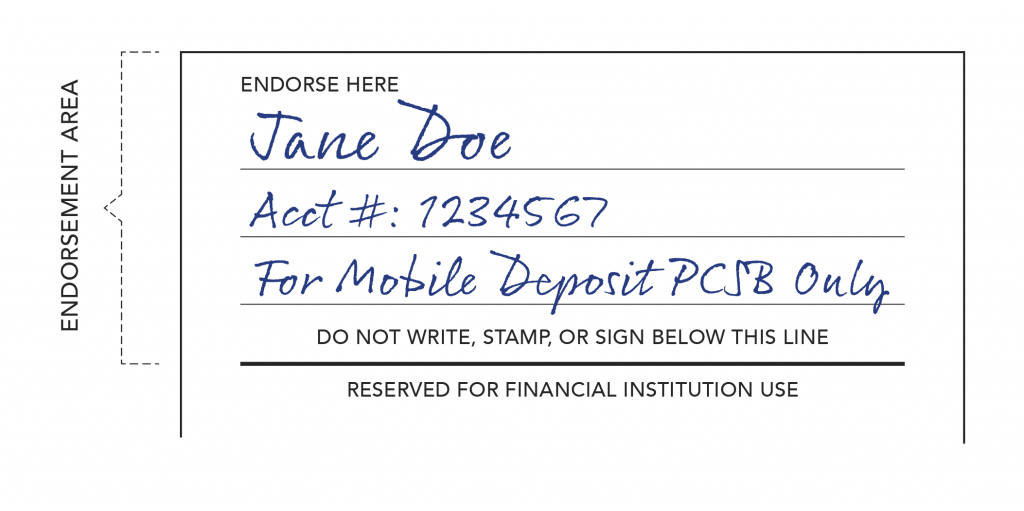

- Mobile Banking App with Mobile Deposit

- Internal transfers between eligible Pacific Crest accounts

- Account to Account (A2A) – make external transfers to your bank accounts at other financial institutions connected through Plaid (read more about Plaid and an alternative option below)

- Set up numerous account and transaction alerts delivered by text or email

- Opt to safely receive and access your monthly Statements electronically

- Communicate securely with our Client Services Team

Additional Features for Checking Accounts:

- Bill Pay

- Person to Person (P2P) payments

- Debit Card management

Enrolling in Personal Online Banking

Follow these directions to verify and set up your online account.

From a web browser, click on the orange “Personal Banking” button at the top of the page and follow the prompts:

- Click on “New User? Register Here”

- Agree to Terms and Conditions

- Account number

- Account Type: Checking or Certificate of Deposit. For Money Market, please select Checking

- The last four digits of your Social Security number or Tax Identification Number (TIN)

- Zip Code

- The security code you receive by either text message or phone call

- Create a permanent password

Plaid

Pacific Crest uses Plaid to help keep customers’ information secure when establishing transfers or connections to other financial institutions.

What is Plaid?

Plaid is a financial technology company that serves as an intermediary between third-party financial applications and users’ bank accounts.

What does it do?

To perform an external transfer, we need to verify your bank account. Users can securely submit their information through Plaid, which facilitates secure data transfer between financial institutions—enabling the necessary communication to allow account verification in a few seconds.

What measures does Plaid take to safeguard your financial information?

Plaid uses advanced security and best-in-class encryption protocols to protect your data during transmission. Read more about Plaid’s security best practices on its Trust and Safety page.

Alternative Verification If you want to bypass Plaid, you can use a micro-deposit verification method. This can take a few days to complete.

- When setting up a new account in External Transfer (A2A), click the ‘X’ in the upper-right hand corner of the Plaid popup to close it. Another page will open for you to add your bank account information. You will need the Name of the Account (your official name on the account), Routing Number, Account Number, and Account type, checking or savings.

- After submitting, two small deposits are posted to your external bank account, and an email is sent to you to complete. In the email, you will be instructed to enter the exact deposit amounts to verify the account.

FAQ – Online Banking

After the initial setup, I want to reset my password. What do I do?

Go to settings in the upper right corner, select “Login Help,” and then from the dropdown menu, select “Forgot Username” or “Forgot or Reset Password” and follow the prompts. You will need to verify your security information, including your account number.

Can I set up account alerts?

Yes. Pacific Crest has established several pre-set alerts for your protection. For example, you will now receive a text message alert any time your email address, password, or phone number is changed. You can customize your alerts in account settings.

Will I have access to my previous transaction and statement history?

You will have access to up to 24 months of transaction and statement history. To access older account history, contact us directly.

Can I download the new Mobile Banking App and access my accounts, or do I need to log in to the Online Banking system from a web browser the first time?

You must initially access your account from a web browser. Both platforms require you to verify your security information the first time you log in. Please see the Mobile Banking App section on this page.

Where can I view the Online Banking Agreement?

Pacific Crest’s Online Banking Agreement.

How can I protect my security and privacy?

Your security and privacy are of the utmost importance to Pacific Crest Saving Bank. To protect both you and your accounts, we recommend that you visit www.paccrest.com/privacy and security.

Can I use Mint, QuickBooks, or Quicken?

You can establish an automatic download from Pacific Crest’s Online Banking to Mint, QuickBooks, or Quicken.

Who Do I Call if I Need Help Using Online Banking?

We’re here to answer your questions during our regular business hours at (425) 670-9600.