Business Online Banking and Mobile Banking App

Business clients can manage their accounts using our advanced version of our Online Banking platform and Mobile Banking App.

Show Details

Online Banking for Business key features include:

- Provide and manage access for additional approved users

- Initiate and approve ACH files and Wire transfers

- Review account balances and activity conveniently in one place from any device

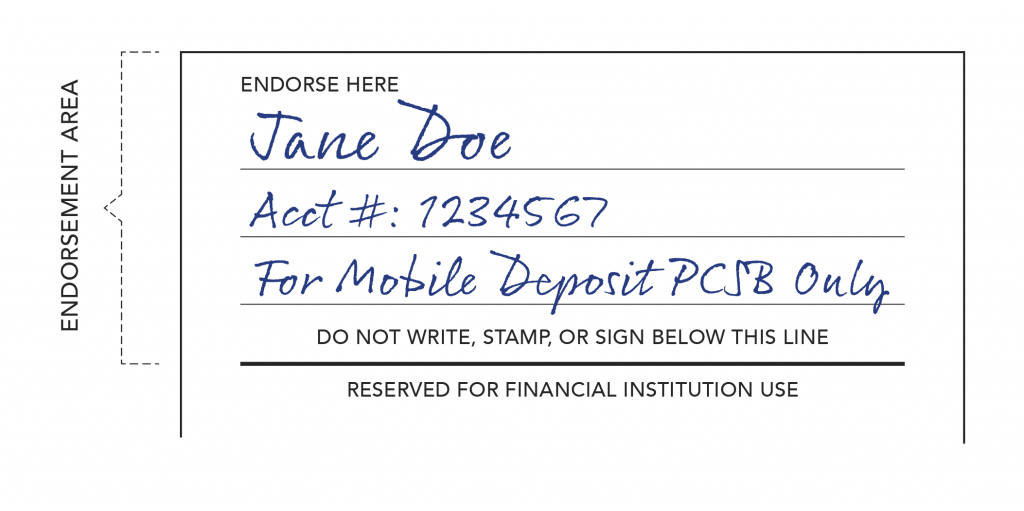

- Mobile Banking App with Mobile Deposit

- Internal transfers between eligible Pacific Crest accounts

- Account to Account (A2A) – make external transfers to your bank accounts at other financial institutions connected through Plaid (read more about Plaid and an alternative option below)

- Set up numerous account and transaction alerts delivered by text or email

- Opt to safely receive and access your monthly Online Statements

- Communicate securely with our Client Services Team

Additional features for Checking Accounts:

- Remote Deposit Capture (RDC)

- Bill Pay

- Person to Person (P2P) payments

- Debit Card management

Validating External Transfer Accounts

To perform an external transfer, we need to verify your bank account.

Plaid

Pacific Crest uses Plaid to help keep customers’ information secure when establishing transfers or connections to other financial institutions. Plaid is a financial technology company that serves as an intermediary between third-party financial applications. Users can securely submit their information through Plaid, which facilitates secure data transfer between financial institutions—enabling the necessary communication to allow account verification in a few seconds. Plaid uses advanced security and best-in-class encryption protocols to protect your data during transmission. Read more about Plaid’s security best practices on its Trust and Safety page.

Alternative Verification

If your financial institution is not listed in Plaid or you want to bypass this service, you can use a micro-deposit verification method. This can take a few days to complete.

- When setting up a new account in External Transfer (A2A), click the ‘X’ in the upper-right hand corner of the Plaid popup to close it. Another page will open for you to add your bank account information. You will need the Name of the Account (your official name on the account), Routing Number, Account Number, and Account type, checking or savings.

- After submitting, two small deposits are posted to your external bank account, and an email is sent to you to complete. In the email, you will be instructed to enter the exact deposit amounts to verify the account.